28+ debt to income for mortgage

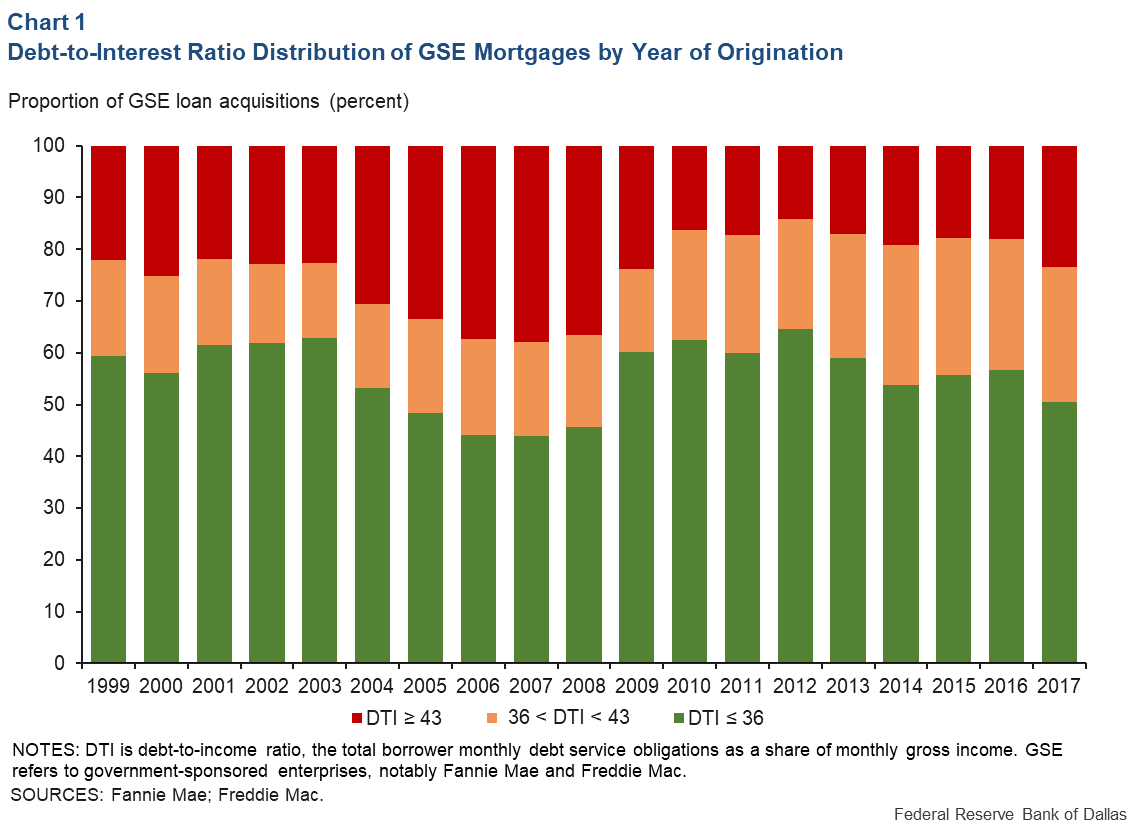

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

The 28 36 Rule How To Figure Out How Much House You Can Afford

Estimate your monthly mortgage payment.

. See how DTI works and how it impacts your mortgage. Lenders prefer you spend 28 or less of your gross monthly. Web The Federal Housing Finance Agency has pushed back the implementation date of some of the adjusted fees set to apply to mortgages purchased by Fannie Mae.

Web You can get an estimate of your debt-to-income ratio using our DTI Calculator. Web 6 hours agoPersonal loan lenders determine interest rates by weighing a number of factors including the applicants credit score and debt-to-income ratio. Try our mortgage calculator.

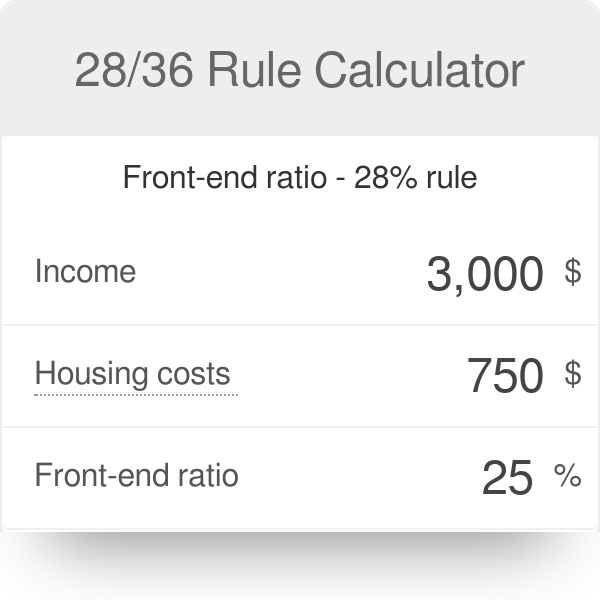

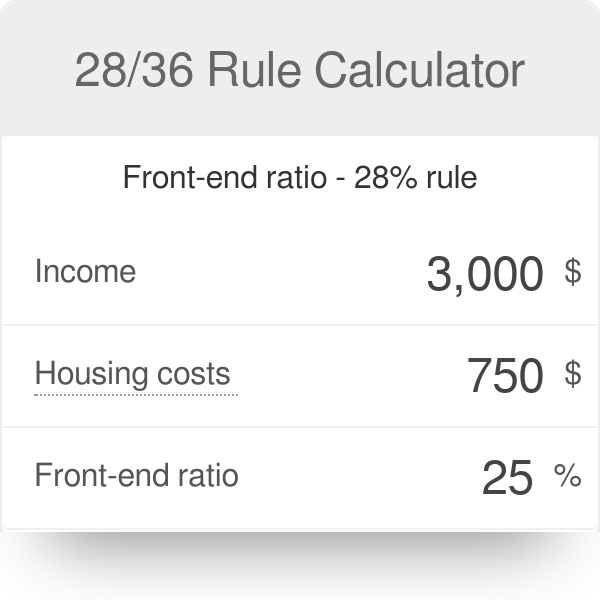

Use NerdWallet Reviews To Research Lenders. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward housing costs.

Web The 2836 rule is a good benchmark. Your debt-to-income ratio compares your monthly debt payments against your gross monthly income. Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. How Much Interest Can You Save By Increasing Your Mortgage Payment. Get Preapproved Compare Loans Calculate Payments - All Online.

Web 2 days agoIn order to buy a co-op in New York City your debt-to-income ratio should ideally be in the range of 22 to 24 percent our experts say. A Critical Number For Homebuyers One way to decide how much of your income should go toward your mortgage is to use the 2836 rule. Take Advantage And Lock In A Great Rate.

Compare the Top 5 Best Mortgage Lenders for 2023. Browse Information at NerdWallet. Ad See how much house you can afford.

Why Not Borrow from Yourself. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. Take Advantage And Lock In A Great Rate.

Ad Learn More About Mortgage Preapproval. Free Shipping on Qualified Orders. Ideally lenders prefer a debt-to-income ratio lower.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Youll usually need a back-end DTI ratio of 43 or less. For example if your monthly pre-tax income.

Ad Shop Devices Apparel Books Music More. Get an idea of your estimated payments or loan possibilities. Browse Information at NerdWallet.

Ad Learn More About Mortgage Preapproval. Share of Income Spent on Mortgage Zillow Home Value Index December 2020. Top Lenders in One Place.

Web Here are debt-to-income requirements by loan type. Ad Find the Best Mortgage Lender for You. Web To qualify for an FHA loan you generally must have a FICO score of at least 580 and a debt-to-income ratio DTI of 43 or less including student loans.

The actual ratio varies. Use NerdWallet Reviews To Research Lenders. Ad Compare Home Financing Options Online Get Quotes.

Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Web What is the 28 36 Rule of debt ratio.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Put Your Home Equity To Work Pay For Big Expenses. If your home is highly energy-efficient.

Is Family Mortgage Debt Out Of Control Jennifer Nelson

Covid 19 Sba Economic Injury Disaster Loan Money Man 4 Business

Videos To Spark Action Debt Consumer Financial Protection Bureau

10 Zero Down Payment Mortgage Templates In Pdf Doc

28 36 Rule Calculator

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Ex 99 1

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

:max_bytes(150000):strip_icc()/analyzing-the-expenses-836794228-5b47a5f746e0fb0037ff1b96.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Shannon Janecek Operations Manager Homexpress Mortgage Corp Linkedin

Exhibit 99 1

Need A Mortgage Keep Debt Levels In Check The New York Times

Debt To Income Ratio For Mortgage Definition And Examples

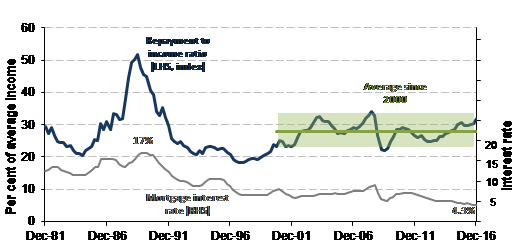

Understanding Housing Affordability Openforum Openforum

How Much House Can You Afford The 28 36 Rule Will Help You Decide

The 28 36 Rule How To Figure Out How Much House You Can Afford